Back in 2013 / 2014, we had the opportunity to work with a local women's football club that was setting its initial steps towards becoming a professional organization competing at the national level. Today, it has become one of the most recognized brands in the world.

At that time, our objective was to help them design and develop the commercial partnerships area with a particular focus on bringing in new sponsors to support the team for the upcoming years. Unfortunately though, back then it was extremely difficult to sit down with top brands, let alone even get to the point of negotiating a proposal. We then targeted “tier 2” organizations although their financial resources were scarce and we basically ended up exchanging brand awareness through the club´s assets for some form of the services they offered. For instance, we signed a deal with a long distance car sharing provider which enabled the players to travel to games using their vehicles.

Today, fortunately, the “playing field” is radically different from what it was back then and women's sport has evolved into a prominent segment of the industry. In this post, we will analyze some of the figures that prove that evolution, trends, relevant updates and some of the challenges it still faces today.

The road to $1 billion in revenues for women´s sport

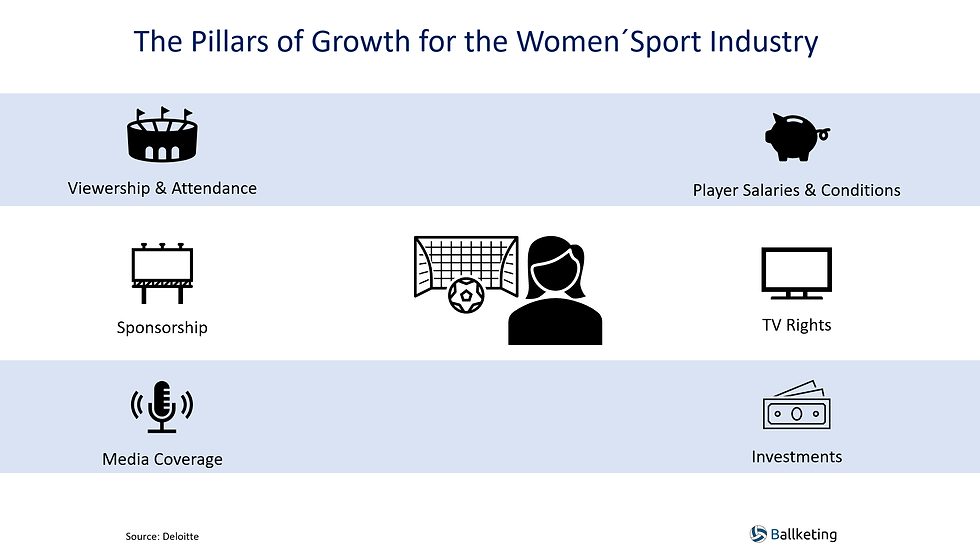

According to Deloitte, men´s sport at the global level in 2018 reached revenues US $471 billion whereas women´s sport revenues fell very short of the $1 billion mark. However, the consulting firm identifies serious potential for growth based in 6 pillars:

Viewership, Attendance & Media Coverage in Women´s Sport

Although revenues are far lower among the women´s industry in comparison to men´s sport, Deloitte also shares that 66% of people are interested in at least one female sport. TV viewership is, in general terms, growing and this should ultimately translate into higher broadcasting revenues. Some optimistic examples include:

The 2019 FIFA Women’s World Cup in France enjoyed a total of 1,475 million viewers worldwide (considering both TV & Digital Platform viewers) and the final alone was watched live by 260 million viewers. The audience per match rose 106% vs the 2015 tournament, with 60% of those viewers being males.

Step by step, women's football is catching into the popularity of men competitions and proof of this is that some games of the US Women's soccer team have been able to gather more audience than some of the finals of the NBA or NHL or that 22% more people in the United States watched the 2019 FIFA women's World Cup final vs the audience of the men's final the year before.

The UK´s Women´s Super League has enjoyed record breaking figures, including the match between Everton & Manchester City in September 2021 (with a projected audience of 800K people) or the first game of the 2021 season between Reading and Manchester United which gathered 311K viewers on Sky (making it the most watched PPV women´s football match in history). In fact, similar interest can be found across Europe as shared by a study carried out by Wasserman, in which it is projected that 88% of fans around certain European markets would watch more women´s football if there were more opportunities to do so. Along those lines, Versus shares a study that concludes that 72% of football fans around the world admit to being more interested in women´s football.

A similar trend can be observed in other major sports such as Tennis, where two Grand Slam Finals in 2018 had more ratings than the Men's Final, Cricket, Rugby or Netball, or the WNBA, as ratings grew 49% in the 2021 season (vs. the season before).

Despite these fantastic statistics, women's sport is yet to bring down a critical barrier for it to increase even further its viewership, which is media coverage. Many official competitions are placed in secondary channels across countries and the amount of news, articles and other content that is created to cover female competitions is much lower than male sport related content. Alex Morgan, US women´s soccer team legend, states that women´s sports only get 4% of the total sport´s media coverage. This is fostering the emergence of media platforms, including Morgan´s own Togethxr, and athletes empowerment movements that look to tackle this issue.

Finally, it remains to be seen how sport in general can recover its “live attendance” figures in a post-Covid environment. Prior to the pandemic, women's sport was enjoying record attendance figures across several sports (football, rugby, basketball, etc.) and markets (Spain, UK, United States, etc.). Major sport properties like the WSL are pushing aggressive agendas towards driving growth in attendance; their goal is that by 2024 average attendance reaches 6K fans, which is a 100% increase vs the 3K average seen during the initial games of the 2021 season and before the pandemic.

Our prediction is that, with time, female competitions will be able to achieve even higher levels of attendance. People “crave” live action and want to go back to experiencing games in stadiums as soon as possible. The more time it takes to do so, the more enthusiasm that is generated / accumulated and probably all sports will benefit from record attendance figures, women's sport included.

TV Rights for female sport competitions across the world

A growing interest in women's sport ultimately should lead to better TV Rights agreements, even if there still are significant differences with male sport. A clear example of this is the record breaking deal signed by the English Women´s Super League worth 7-8 million pounds per season through the 2024 season.

As picked up by the BBC article referenced above, Kathryn Swarbrick, Commercial & Marketing director at the FA, had this to say about the agreement:

"We're going to be broadcasting more live games, reaching a bigger audience and bringing in more revenue than any other women's domestic league in the world."

The map below summarizes major TV broadcasting deals that certain competitions have been able to secure over recent years.

Moreover, in march 2021, Nordic Entertainment group, a European broadcasting company with presence in markets such as Norway, Sweden, Finland or Lithuania, among others, announced a deal to start broadcasting women´s football league games from the main European leagues, including:

English Women´s Super League

Italian Serie A

Germany´s Elite Frauen Bundesliga

Denmark´s Gjensidige Kvindeliga

Spain's Liga Iberdrola

Finally, in June 2021, Dazn and YouTube made official their partnership with the Women´s Champion League in a deal described as "one of the largest broadcast deals in women’s club football history" that will run through 2025. And in October 2021, Dazn also reached an agreement with Ata Football to broadcast Women´s Champion League games and expand its coverage across the United States. From the looks of it, the agreement between Dazn & YouTube is working remarkably well for both brands, as pointed out by Rob Pilgrim, YouTube’s head of sport for EMEA, during the SportsPro OTT Summit:

"UWCL matches had already attracted five million viewers – 85 per cent of which were not previously subscribers to DAZN’s YouTube channel"

The major leagues and competitions are closing agreements worth significant amounts of money but the outlook is these will only increase in the medium-long term

Sponsorship in female sport competitions

Deloitte also shares that the global sport sponsorship market was valued at $44.9 billion during 2019, although female sport, once again, represented a small percentage of that figure. If however, trends in broadcasting and TV right deals remain positive, it is reasonable to think that sponsorship agreements will also become more prominent and of greater value.

The above are just a few examples of relevant sponsorship deals present in the world of women´s sport. In the future though, we believe more “partnership based” deals, just like the Changemakers sponsorship program created by the WNBA, will be the norm. Our three main reasons driving this prediction are:

More companies involved with a sport property implies greater financial support for the league. In the case of the WNBA, this initiative has been key for the development of the new CBA (Collective Bargaining Agreement) that enables the average annual salary for players to reach around $130K, surpassing the 6 figure mark for the first time.

Brands and clubs have a great opportunity to create social impact through women´s sport. In fact, summarizing this concept, Angel City co-founder Julie Uhrman had this to say about the creation of the club a few years ago, as picked up by The Telegraph in this article:

"We don't think of this as a soccer club, we think about this as a platform - one that stands for equality and where we can leverage this incredible investor group of celebrities and athletes to really amplify what it is we do."

Looking at the potential both in terms of economic return and social impact, many brands are entering in programs such as the WNBA Changemakers initiative we just described. This, if done coherently and consistently, enables brands to establish a position in the market that improves the brand reputation. Take the following video from Deloitte as example:

Deloitte is looking to position the brand across all social impact related movements, not only female sport.

Another prime example of a sponsorship deal aimed at improving brand reputation would be the record setting deal between Real Madrid & Qiddiya that seems to be on the table (although it is not yet official as of this date), which would pay the club´s women's team €150 million over the next 10 years. Similarly, Michelob Ultra, has committed to invest $100 million across women´s sport over the next 5 years to give the visibility it deserves.

And why is this important?

Well, not only is it the right thing to do when major brands have the power to influence a great part of society but also, according the Edelman, 64% of consumers (up from 51% on 2017) actually expect brands to act upon social issues / causes, and even factor that into their purchasing process.

Prizes & Investments in Women´s sport

Although valuations for women´s sport properties are not yet close to those of their male counterparts, given the potential of the industry in the future, we believe they certainly enjoy greater levels of investment in the future. This is the same line of thought that Spanish sports business journal, 2playbook, reports in this article that reviews potential opportunities with private investments funds throughout European women´s football. For instance, the current annual budget for a Spanish Women´s Football team ranges between €1 million and €5 million, but take into account that one year ago, budgets were between €150K and €500K. This should serve as prove of the growth these clubs are capable of achieving, which is why private investment funds have shown interest in them. The article also reports that currently, only about 1/3 of the budget actually comes from these type of firms so we definitely identify a window of opportunity in the future.

An interesting trend in this realm is that female celebrities and sport stars such as Natalie Portman, Serena Williams or Naomi Osaka are starting to invest in the National Women's Soccer League (United States). As mentioned above, their aim is to use these clubs as platforms for social change and further development of female football (soccer) at all levels. In fact, their aim is to invest 10% of their sponsorship revenues into projects that help develop the sport and improve the community around them.

There are also opportunities for acquisitions within the industry. So far, some of the most noticeable deals in recent times:

Olympique Lyon paid $3.15 million for a 90% stake on Seattle's team belonging to the National Women's Soccer League.

Real Madrid purchased CD Tacón for around €500K to finally set up its own female section.

Growth in investments should also drive an increase in prize money for major tournaments. The 2023 FIFA Women's World Cup for example, is expected to give around $60 million for participating teams, which is more than double of what was offered in the 2019 tournament. In this sense though, a study from the BBC explains that there are still significant gaps between the prize money awarded in men´s and women´s sport respectively. Take the Football World Cup as an example, the female US National team was awarded $4 million for their victory in 2019 while the male French team was awarded $38 million after winning the 2018 World Cup. In a similar move, the UEFA Women´s Champion´s League will increase the total prize money by 4 from the 2022 season onward, distributing a total of €24 million. What is interesting about this decision though, is that 23% of those funds will be distributed to teams that do not participate in the major national leagues, in an effort to foster the development of women´s football across the continent.

Also in 2022, UEFA will double the prize money for the national teams who qualify for the Eurocup, from €8 million to €16 million. In addition, a total of €4,5 million will be distributed to those teams who let their players participate in the tournament.

Women´s golf is another sport that is increasing its prize money as a result of the emerging interest in the sport. As of 2021, there are 19 tour events that hold a prize purse of at least $2 million (vs 15 of them five years ago) with a special mention to the five majors, who have a purse of $26.3 million, which is a 40% increase vs the same time period.

Finally, and probable more importantly for the long-term sustainability of women´s sports, investments are also being made at the youth level. For instance, FIFA aims to increase the number of women playing football to 60 million by 2026. In this sense, some organizations, such as the English FA are leveraging the capacity of the men´s game to generate revenue to invest back into youth and female sport initiatives:

"While we recognize there is currently a significant disparity between prize money for men's and women's competitions, these are determined by the amounts of money generated through commercial revenue, including national and international broadcast rights. The [men's] FA Cup is the biggest revenue producer for the FA. This revenue enables us to invest back into football at all levels and we have made significant progress to develop the women's game as a result."

Player Salary & Conditions

At the end of the day, all these economic and business related improvements need to translate into better salaries and conditions for players. WNBA Legend Sue Bird has an interesting view which she shared on the People I Mostly Admire podcast. Sue was part of the executive committee that was able to negotiate the new CBA (Collective Bargaining Agreement) for the WNBA and her opinion is that superstars need to be paid more, undoubtedly. This would enable the creation of a merit system and also increase the sense of ownership by players. The risk of not doing so is that the best players can become disengaged with the competition if they feel they are not being paid what they are worth, which ultimately decreases the quality of a given league.

In particular, as Sportico reported, the new CBA in the WNBA implied the following:

The new CBA represents a 53% increase in total cash compensation for players when combining increases in base salary, performance bonuses, and prize pools for newly created mid-season tournaments. Top players can now earn $500,000 per year, more than triple the maximum compensation assigned under the prior CBA. Players will earn just under $130,000 per year on average, meaning average cash compensation for players will exceed six figures for the first time in WNBA history.

The agreement implies a great step for female basketball players, although there is still some ground to cover when comparing vs the NBA. Some data from 2019 (which is prior to the CBA agreement signed in 2020) that was shared in Sue Bird´s conversation with Dr. Steven D. Levitt reinforces this idea:

What we found most interesting from this conversation though, was her response to the question if she found this scenario to be fair. You probably should listen to her full response in the link we shared above but at the end of the day, while she recognizes that for the moment, men´s sport may have more recognition and more commercial appeal, the amount of work female and male athletes put into their profession is pretty much the same.

Her take on the matter is that women´s sport needs to be looked at as an investment with huge potential for growth and as such, they need brands and institutions to “invest” in them. The NBA probably did not make money on “day 1,” but with the correct support and management, it has become what it is today.

Why couldn't the WNBA cover similar ground?

And even though we have used the WNBA and the NBA as examples, the situation is pretty similar across all major sports (except, perhaps, Tennis). In Spain for example, La Liga also reviewed salaries for the female players, establishing a minimum salary of €16K, as reported by 2playbook, which is far below the number of male players. Similarly, in February of 2022, the NWSL announced a new collective bargaining agreement that will include "free agency" and an increase of 60% in the minimum salary (with subsequent increases of 4% per year) as the main highlights and, US Soccer will pay the same salaries to men & women athletes participating in friendlies and tournaments after a settlement agreement was reached with the US Women´s National Team.

Our prediction though is that in the long term, the situation will be much more balanced as women´s sport gains in popularity, influence, and revenues.

Facing the road ahead: Opportunities & Challenges

It seems fair to say that the women's sports industry is well on track to becoming as relevant as men´s sport in the future. The growth in the number of fans being attracted to the game is driving a greater professionalization of the industry and an increase in TV rights, investments and sponsorship deals. Similarly, new initiatives and innovations that are particularly focused on female sport serve as additional proof that serious potential is identified behind it.

A clear example of this “The Fan Project,” created by Sports Innovation Lab, which, as described in this Sportico article, is a women’s sports-centric research endeavor created to get a better understanding of the female sports fan. The project is supported by major sport organizations such as the WNBA, NWSL, LPGA, UFC, WWE and the Women’s Sports Foundation and its goal is to drive investments in the sport, increase media coverage and attract even more sponsors to the competitions.

Keep in mind that gathering the most amount of a fan´s behavior towards a given sport is appealing to sponsors, as it enables them to segment and personalize their campaigns with greater detail. As shared by Alycen McAuley, Monumental Sports & Entertainment senior vice president in this article:

Women drive the majority of consumer purchases -80% –either with their buying power or their influence, yet corporations have failed to recognize women’s sports as ‘prime real estate’ to meet, engage and dialog with these valuable consumers. And at a time when consumers are looking for authentic relationships with brands that respect their diversity and values, women’s sports – and specifically the WNBA – offers an unmatched opportunity.

Moreover, a study from The Space Between concluded that fans of women´s sport are 25% more likely to purchase sponsored products vs male sport fans. And aside from the apparent commercial benefits, women's sport is associated with a set of values such as Inspiration, Family or Inclusiveness, as shown by the following chart created by Nielsen:

In fact, this concept ties in with our “purpose driven sponsorship framework,” which we described in this post.

At the same time though, there are many challenges in the road ahead that need to be faced. Front Office Sports interviewed some of the top female executives of the North American leagues and they pretty much summarized the challenges along topics such as:

Governance: Putting female leaders in the stop spots of an organization.

Developing talent at the youth level to ensure the quality of the league in the long term.

Attract and nurture new fans: They are key to ultimately bring in new sponsors, investments, etc.

Perhaps, Erika Nardini from Barstool Sports, summarized it best when talking about the challenges ahead:

The biggest challenge is people at the highest level are not taking enough risk to remodel, reimagine, and rethink how things are done in order to create more opportunities for women in sports.

As female sport keeps growing though and become even more professional at the global level, we are pretty sure it will overcome these challenges and increase their relevance within the overall sport industry as well as their positive impact in society. Perhaps Tamy Parlour, CEO and co-founder of the UK Women’s Sport Trust, summarizes it best in this quote:

“We believe the next decade will be a gamechanger for women’s sport and with some concerted focus on key areas such as visibility and data we can ensure it is not only commercially viable but sustainable for decades to come.”

We hope this analysis provided enough highlights into the current situation, opportunities and challenges around the women's sport industry. We are aware that there are still many topics to discuss and in particular, we predict the next frontier to tackle is going to be female eSports, although this will be something we hope to look into in the near future.

Either way, “stay tuned” as our aim is to bring you the most relevant updates, analysis and business cases so you can keep up to date with its evolution in the near future.

Keep Safe.

Comments