Fila vs Reebok & the state of the sports apparel industry

- Ballketing

- Aug 30, 2021

- 11 min read

Updated: Mar 22, 2022

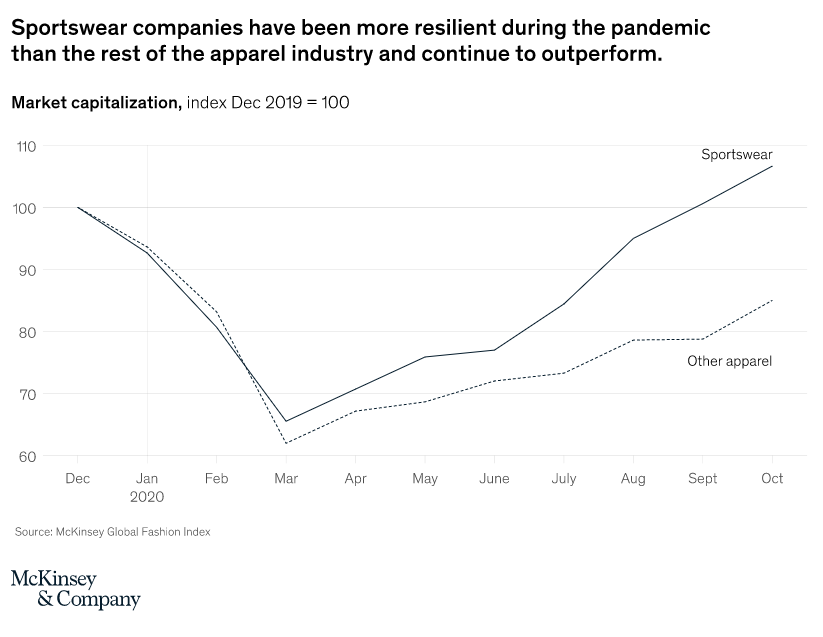

The sports apparel industry is back in full speed after a challenging 2020 in which, according to McKinsey´s research, it contracted for the first time since the 2007-2008 crisis. It still was able to outperform the overall apparel industry though:

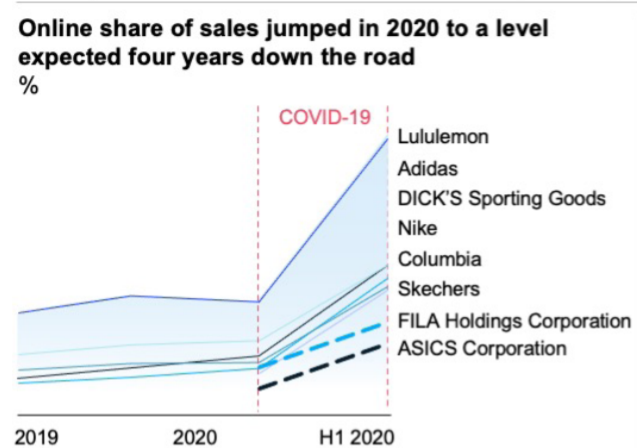

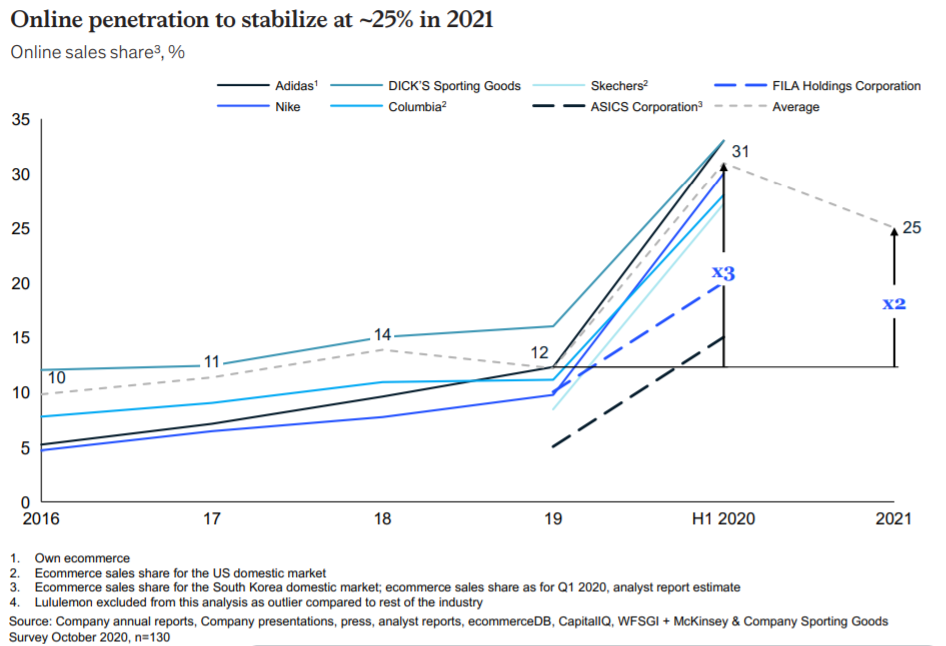

Successful sportswear brands adapted to the events of the pandemic by, among other things, reinforcing their D2C & eCommerce strategies as shown in the following chart:

Nike was able to navigate through the storm effectively thanks to a fantastic transition into becoming a D2C focused brand, which currently represents 33% of its business according to eMarketer. Comparing it to Adidas, its biggest rival, Nike achieved sales figures of $37.4 billion ( “only” a -4,6% vs 2019) while Adidas revenues were $19.9 billion (a decrease of -19% vs 2019).

Similarly, just as we analyzed in this blog post, Gymshark & Lululemon have emerged as relevant challenger brands in the category as proven by their fantastic results. Gymshark achieved sales of almost $360 million and is currently selling in more than 170 countries. Meanwhile, Lululemon reported 2020 sales of $4.4 billion, which is an 11% increase vs the previous year.

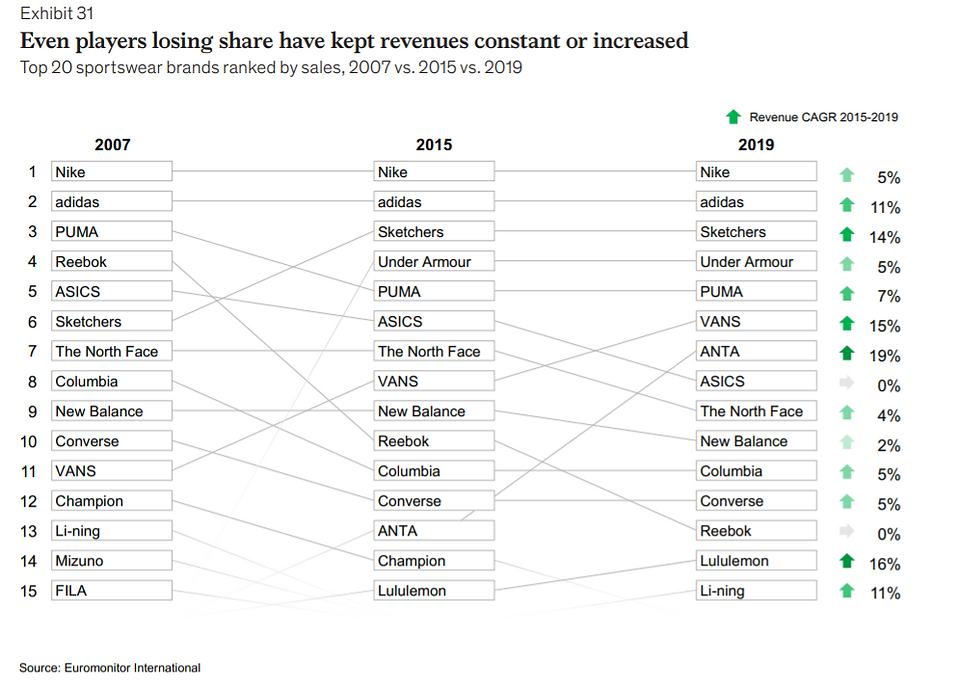

The following chart sums up quite nicely how the biggest players in the industry were performing prior to the pandemic, where the overall health of their revenue was quite strong:

The post-pandemic era has also been an interesting period for Fila & Reebok, two iconic brands that blossomed during the 80s & 90s and are looking to make powerful comebacks relying on “nostalgia,” their legacy and improving the overall brand experience. In this post, we will highlight some of their key business indicators, the current business environment they operate in and explore potential opportunities for growth for them and for sport apparel brands in general.

Authentic Brands Group acquires Reebok from Adidas

The summer of 2021 finally saw Adidas confirming the sale of Reebok to Authentic Brands Group (AGB) for a reported $2.5 billion, after purchasing it back in 2005 for $3.8 million and rejecting an offer from AGB in 2020 for $1 billion.

The last several years have been challenging for Reebok:

Revenues fell around 17% in 2020 vs 2019.

Earlier this year it was announced that UFC ended its partnership with Reebok and was replaced by Venum.

In 2020, it terminated its sponsorship agreement with Crossfit after the controversial remarks by its previous CEO.

The team at Statista shows Reebok´s revenue evolution between 2006 and 2020, which proves their "unstable" situation over the years:

Despite this context, Authentic Brands Group still believes in the power of the brand, it's legacy and capacity to recover its full potential. In fact, Jamie Salter (AGB´s CEO) believes that Reebok´s revenue can grow to $10 billion in the next 5 years, with 50% coming from fashion and the other 50% from athletic related products. The main difference between AGB & Adidas is that the former is accustomed to managing multiple brands and can surely leverage from cross-brand partnerships among their wide portfolio. As Liam Killingstad from Front Office Sports analyzes, the advantage of belonging to Authentic Brands Group is that Reebok can divide the cost of retail space among their wide portfolio and thus enjoy a greater push towards profitability. Their recent partnership with JD Sports, in which the retailer will sell Reebok apparel in almost 3.000 stores is proof that they are serious about this strategy.

Moreover, their overall distribution strategy for Reebok is witnessing significant changes. For instance, ABG has expanded its deal with Tristate, who will become the official distributor of the Reebok brand in China, Taiwan, Hong Kong and Macau, where it will compete head to head with the Anta Group and its portfolio of brands, including Fila. They have also closed similar partnerships in the United States, where Foot Locker will be an exclusive distributor for some Reebok products, and in Europe, in which the Italian company New Guards Group will be responsible for distribution in stores, the online channel, and other multi-brand points of sale.

Fila: contributing almost half of Anta´s total revenue

In 2009, in what some considered a surprising acquisition given that it still was not considered a relevant sport apparel brand from a global perspective, Anta Sports took control of Fila.

Today, the brand contributes 44% of Anta´s total revenue, helping the group achieve a remarkable 39% revenue growth during 2021 and consolidate itself as the “third highest market capitalization sportswear company in the world.” It is worth noting that Fila has been able to achieve 10 years of consecutive revenue growth and currently has a 72,3% gross profit margin (vs 70,5% in the previous year).

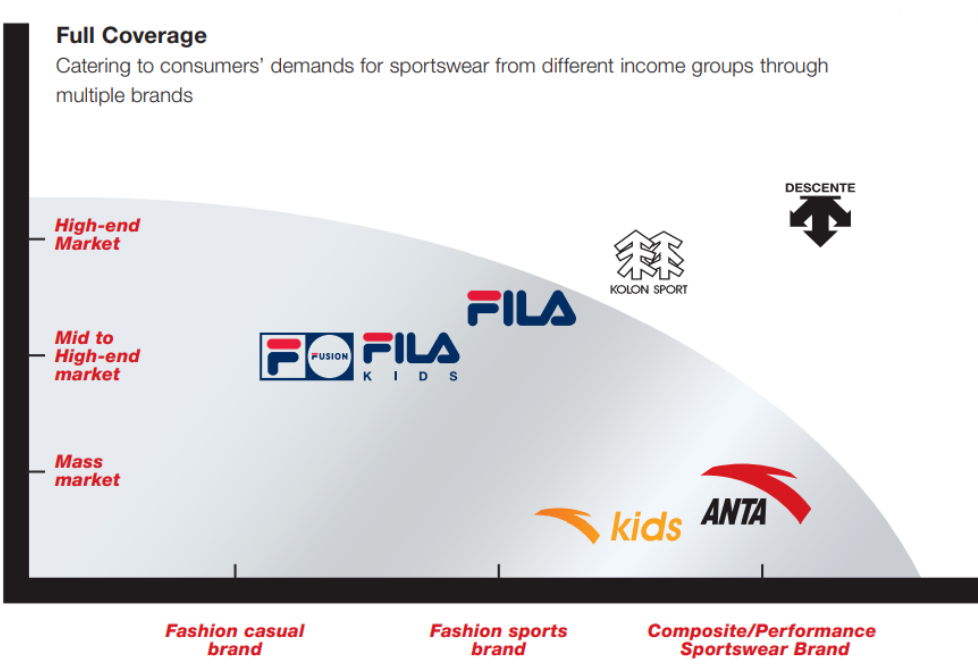

Anta believes that the shift towards becoming an “affordable luxury” brand who focuses on product quality, branding and channel execution has been the key behind its outstanding results and will look to fuel growth from there. The following chart summarizes well how each brand of the Anta Group fits into the overall portfolio:

6 opportunities for sportswear brands in the future

The pandemic shook the roots of the apparel industry and it is now facing a new context where we identify 6 opportunities that sportswear brands like Fila & Reebok, who benefit from being backed by massive corporations committed to seeing them thrive, can tap into and adapt to the new market dynamics.

Moreover, Euromonitor projects an astonishing 9% growth from 2021 to 2025, valuing the market at $395 billion, with China being the market with most upside (Predictably, this could be more beneficial for Anta...)

As such, both Fila & Reebok will look to take of advantage of the momentum by leveraging on the following market trends.

eCommerce & D2C are here to stay

As we saw above, after the breakout of the pandemic, sporting good brands had to forcefully improve their eCommerce & D2C efforts; according to McKinsey, before 2020 online sales growth averaged at around 2% per year but since the beginning of the pandemic, this figure increased to 16% points in six months.

The following chart also summarizes quite well the increase of online sales experienced by the major sportswear brands, including Fila:

But this is far from a patch or a “trend;” online purchases are already embedded in the customer's behavior and they are surely here to stay. James Zheng, Executive Director and Group President at ANTA Sports (the group that currently owns of Fila) shared his view on this very topic:

“eCommerce will become the single most important channel for many sporting goods brands around the world, while direct to consumer (DTC) will become a critical success factor for every brand.”

In store experiences need to go beyond the act of purchasing

Store traffic obviously decreased during 2020-2021 but at some point it is bound to bounce back and still be a prominent factor of brand strategy. In fact, many industry leaders such as Under Armour´s Chief Product Officer, believe that “retail will never go away.” For this to happen though, the brick & mortar experience has to be outstanding and provide some form of value that digital cannot deliver.

This, for example, could be something related to sport activities. It is a pity that Reebok no longer has its agreement in place with CrossFit as it could offer in store workouts. This is actually something that we have seen New Balance test out in Spain, where they actually have set up a partnership with El Corte Inglés, a major department stores brand in the country, to set up Crossfit studios within selected locations. Joe Preston (CEO & President at New Balance) shared his view on the role that the store will play in the future for sport apparel brands:

"Firstly, I think we need to redefine what a sporting goods store is today. Many stores are niche-oriented, while this crisis has underscored the breadth of how sporting goods can contribute to everyone’s activity. Secondly, stores can have a significant role in enabling the last mile: stores can literally serve as a warehouse for a specific market area. Consumers expect more in terms of experience, and the most important is a seamless omnichannel experience. In conclusion, if we just re-open our stores under the old model, we’re really missing an evolution of consumer needs that has taken place, and a great opportunity. Sporting goods retail needs to cater to the everyday person that wants to be inspired to be more active."

Augmented reality technology is another concept that fashion brands in general are looking to embrace as a method to enhance the store experience, but it does not seem like the mass market has adopted it quite yet. AR may be a more "middle term" solution for fashion brands in general...

The following chart developed by McKinsey demonstrates how consumers search for sport apparel products, where 65%-71% of them adopt an omnichannel approach.

In a way, FILA has already started going down this path, as Anta has announced a partnership with Hyatt to open a "Fila-branded" hotel in Shanghai.

Emerging sports & athletes as catalysts to impact pop culture: The opportunity behind women´s sport

Reebok was obviously successful with emerging sports such as Crossfit or Aerobic back in the 80s to the extent that it was able to become a market leader for some time. During the 90s, it was even able to sponsor some of the most culturally relevant NBA superstars of the time like Allen Iverson or Shaquille O´Neal.

Similarly, and as we pointed out in our newsletter, Anta supports “odd” but “beloved” superstars like Klay Thompson or Rajon Rondo and Fila itself has made a big push into Tennis thus far.

From our point of view, it is time for these brands to get fully behind women´s sport, especially for Reebok. The industry is blooming as we covered in this post, and there are opportunities for major visibility at the global level. Moreover, brands like Athleta (Gap) are reaping the benefits of partnering with major female athletes like Simone Biles or Allyson Felix as proven by the 35% increase in sales (vs 2019) they reported in August 2021.

Supply chain efficiencies will be "key to play"

Mr. Zheng, from ANTA, also cites supply chain efficiencies as a key success factor in this McKinsey report. As he points out, their "time to market for new shoes is around six weeks, compared to 15 to 18 months of our competitors," and that "strategic alliances and partnerships with key suppliers will be essential for the future, in order to respond quickly to market change and reduce lead times."

In this regard, an element worth noting is that the “click & collect” experience is something that customers have embraced. Taking the U.S. market as a reference, eMarketer calculated a growth rate of almost 107% in 2020 vs 2021 and that it represents 9,1% of retail eCommerce sales. Moreover, it predicts click & collect could end up contributing 9,9% by the end of 2021.

Take a look at this graph created by the team at Nielsen that supports this:

Adapting to all of these demands from the supply chain side will be “key to play” and not “key to win.”

Nostalgia-based marketing: The content marketing opportunity for the future

From a legacy standpoint, both Reebok & Fila have powerful legacies that could help them develop nostalgia-based marketing campaigns.

As we mentioned above, Reebok was a very relevant brand from a cultural standpoint back in the 80s and 90s and even partnered with global superstars across different sports. In fact, during the period in which Adidas was looking for suitors to purchase the brand, music artist Master P and former NBA player Baron Davis officially declared interest in buying Reebok and making Iverson a pillar of their brand strategy

“The way we look at Michael Jordan for Nike, we look at Allen Iverson that way in Reebok. We need to bring him to the forefront. We need to bring in better designers. We also need to make this for the Millennials. And I think that that would be a game changer.”

Simply look at the type of powerful ads the brand used to make with Iverson as ambassador:

Fila itself was also quite a relevant force in the NBA during the 90s as it sponsored Grant Hill, one of the many talents that were considered to have enough potential to take Michael Jordan´s place as global NBA icon:

What makes the concept of "nostalgia" so powerful is that it taps into the essence of human behavior; we are somehow wired to remember the cool things of "the good old days." In our view, there are 4 elements that define the potential of a “nostalgia-based marketing” campaign:

Story: As we have discussed, both Fila & Reebok can rely on their legacy to create meaningful stories behind their campaigns.

Market opportunity: There seems to be a trend towards “all things retro,” particularly in the world of sports, as proven by the comeback of sports cards, the popularity of “The Last Dance” on Netflix or the release of Space Jam 2.

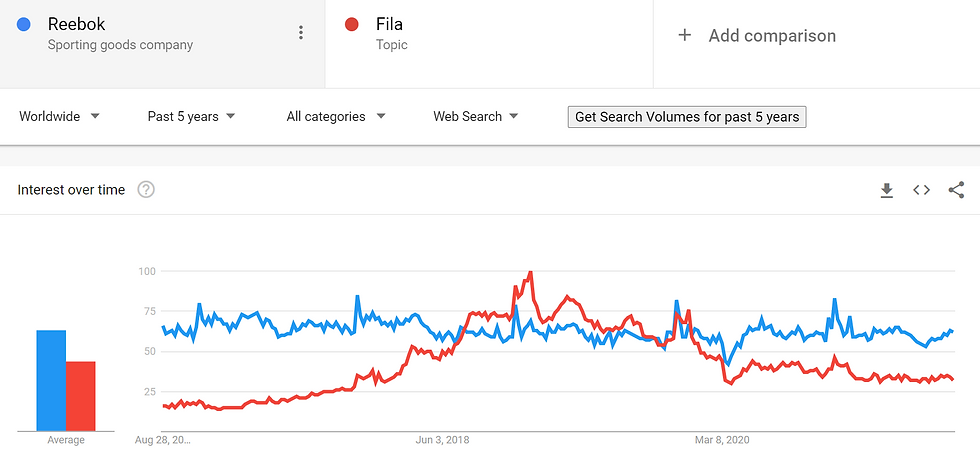

Recognition: Both brands are quite popular at the global level as proven by the attached Google Trends chart, although the real key is to be recognized by the segment of the market you want to go after:

Resources: Thinking and designing is great but at the end of the day, brands need to execute and for this, they need access to financial resources, talent, production capacity and robust partnerships (agencies, suppliers, retailers, etc.). By belonging to powerful business groups like Anta and Authentic Brands Group, Fila & Reebok can rest assured they have some of the best resources at their disposal.

Exploring the NFTs frontier in the sports fashion industry

A "mid to long term" option for these brands could be to create new product lines supported by athletes or pop culture personalities, mint them as NFTs and then create special "offline events" for the different token holders. Then, those ticket holders could meet those personalities, have VIP access to special collections, etc.

Going even further, another opportunity is to partner with designers or customers to design a new line of products, put them on sale, and let these creators benefit as well thanks to the NFT technology supporting it. This could also be a great opportunity for brands to get close to culture, technology and co-creation methodologies.

Finally, and now that everyone seems to be talking about it, NFT technology could also have its room in the "metaverse" but that may be too futuristic at this point; it may be something worth keeping in the horizon though...

Customer, product, & brand: Mastering the marketing fundamentals

If you have a sportswear brand of your own, it is important to understand that without mastering the marketing fundamentals, identifying external opportunities is pretty much worthless. It really comes down to customers, products and, brands.

First of all, start digging deep into who your potential customer is, what are their behaviors, needs, and potential choices available to them:

What are the triggers that make them interested in the category?

What are the benefits they see in the product you offer?

What are the channels they are visiting regularly and more importantly, which of those channels do they want to engage with brands like yours?

Is your category the only one that can tackle those needs?

Once you really understand those details:

How does the product you offer can meet their expectations?

What is it about the product that make them choose you over the others? Is its functionalities? Is more "emotion-driven"?

In essence, you can refer back to Seth Godin´s framework of "Who is it for?" and "What is it for?"

Finally, recognize the value of the brand promise.

What is about your story that resonates with your customers?

What are the associations between your brand and their emotions? (Status, recognition, confidence, etc.)

It is key to make sure there is a fit between your message and what the audience expects to hear (you probably will need to test several tactics until you reach message / market fit...)

Going back to Fila & Reebok, the former seems to understand their customers quite well, has a clear vision in terms of offering "affordable fashion" to them and has a powerful brand story behind to share. The results definitely seem to point in that direction...

On the other, it will be interesting to see how Reebok approaches the marketing fundamentals from now on with Authentic Brand Groups behind them. The "brand story" definitely has potential but the key will be to see if they make changes to their target market and their current product line.

With those in place and the resources available to them, we hope to see them pursue some of the 6 opportunities we outlined above.

In any case, we will bring you further updates of how these two iconic brands are challenging the status quo of the sportswear industry and of other updates that will help learn from the best in the market and take your sport apparel brand to another level. And, if we can help your brand work on your marketing fundamentals and how to take advantage of all the opportunities that lie ahead, feel free to reach out through the contact form.

Keep safe.

Comments